- Home

- Ben Anderson

Homeowner Now Page 3

Homeowner Now Read online

Page 3

chose could be paying for add space online, but it's not their listing. Bad to worse, that realtor refers you to a loan officer they're in cahoots with to make sure they come out ahead on the deal – not you. Again you aren’t choosing, therefore most likely you end up getting a bad loan.

When buying a home, the typical buyer doesn't interview very many realtors; but when selling they do. Why is that? In a selling position, you already have some transaction experience and you want to get as much for your home as the market will allow. So you make sure to find a realtor who you believe will negotiate the best deal. Most first- time buyers don’t do the same, because they're unaware of the potential pitfalls. And this could result in you paying the price for years if you get the wrong loan, or the wrong home.

Think about all the options you have on where to start. It's generally one of three places: online search, real estate website, or a referral. If you are doing an online search (Google) you'll likely find paid lead generation companies – the big players today – who'll take you through an exhausting series of application questions. Additionally, you're required to enter lots of personal information into an online application. You hit "Submit" then hope and pray a knowledgeable loan officer calls you back.

Did you get to choose, or is the system choosing for you? Really think about this. Did you know that on the other side of that search are lenders, loan officers, and realtors paying for your data? This is called Lead Gen 101.

Now we'll look at it from the other side: Let's say I am a realtor or loan officer and I don’t have leads. What do I do? Well, I contact a big lead generation company, one that comes up on a random search, and I talk to the sales rep who cheerfully says, "For only $1000 a month, we'll provide you with ten quality leads!"

Okay, the "only" sounds like a lot of money to my ears, but I bite because, hey, I need leads to close loans or sell homes.

YOU, the buyer, are that lead.

There's a fundamental lack of transparency here because you, the buyer, want to own a home and you're trusting a lead generation company to provide you with an expert. But you have no choice in the matter on who calls back or reaches out to you. Do you get to choose who that person is? No, you don't! Does the lead generation company have a vetting process? Maybe they do and maybe they don't. You have no way of finding out. How do you know if they have the necessary experience? Maybe they took their test just

yesterday? Do you know where their office is? Do they even have an office? Are they even licensed? Maybe, just maybe, they aren’t even in the industry ... welcome to yet another Internet scam!

For all we do to protect our identity and security, we are often quick to offer up all of our personal information to a complete stranger when we're looking for a home. That is not safe; that is not smart; and equally important, that is not choosing.

You want choices; you want to be able to choose the best; and you definitely want an expert. But the process is self- serving. Why? LEADS. You are not a customer, you're a lead. When you shop online and alight on a landing page for a mortgage quote, you just became a lead. When you are looking at properties online and ask for an agent to call you, you just became a lead. Once you hit "Submit", your information goes viral, and gets disseminated and sold – but to whom?

Loan officers, lenders and realtors are paying for your data. Caveat emptor. Buyer beware! Not only are you not choosing, but you and your personal information are being sold – and you have no idea who's buying it, or how they intend to use it. Crazy, right?

How do I know this? Once upon a time, I used to buy leads from third parties like this. But the more I learned the system, the more I saw it for what it was. So I stopped and said, "There must be a better way!"

Over time and through hard-won experience, I have achieved the right to call myself "an expert loan officer". I know the ins and outs. I have worked with, trained, managed and coached thousands of other loan officers. Time and time again I meet loan officers who haven't gone through specialized training. And I'm telling you, it's a scary number of people. Sadly, too many buyers are entrusting their most important investment in the hands of someone vetting you, who you have not properly vetted to serve you.

The problem exists because most buyers don’t have a clue where to start. They don’t understand the process, they don't know what to do, other than cross their fingers and google, hoping against hope they land on a site with some integrity – and not an uncaring lead generating mill. And, like I said, if you start off bad, with a loan officer or realtor who doesn’t have sufficient knowledge of the process, it quickly goes from bad to worse.

In some cases, you are referred to a realtor or loan officer by someone you know. Sometimes another person's good experience is a reliable indicator. But as the tried and

true saying goes, "Your results may vary." So please look up the person who you're being referred to all the same. Make sure they have several positive reviews and a strong online presence. Otherwise you could be referred to a loan officer or realtor with limited experience; and the person who referred you just happened to luck out. While referrals are a leg up on entering your information in blindly, you are still not choosing for yourself. Someone else is choosing for you.

I realize that I am giving you insider information. And most lenders, loan officers, loan brokers, and real estate agents do not want you to know this valuable stuff. But I do it because I care most about giving you the ability to choose. I care most about you, the home buyer, being served a plate of justice; and no longer falling prey to quasi experts leading you down the wrong road. A road of grief and misfortune.

That is my key impetus for writing this book – to bring awareness to the fact that the home buying system is not built to give you a choice. And then to walk you through the steps to turn things around and put YOU in the driver's seat.

CHAPTER 5

BEWARE OF HOME OWNER SITES

The process of becoming a homeowner is broken, and the way in which a homeowner finds a loan officer or real estate agent is also broken. Coming out of the Great Recession where the market collapsed, regulation was added, technology has advanced but the process is still defective. The home buying process does not allow for transparency and most buyers just don’t know where to start. If you are looking to buy your first home, your next home, or your last home, stay tuned and you will learn where to start and what to avoid.

When you land on an Internet site for home ownership, these sites require you to enter in several pieces of confidential information: name, email address, date of birth, social security number, employer's name, job title, income, and more. You then hit "Submit", and this confidential information is sent to a 3rd party or multiple 3rd parties who are paying for leads. You are lead to think they are only inquiring about financing, but you just became a lead, and to multiple lead buyers. This lead (you!) gets sent electronically to multiple loan officers, or loan companies. Then you wait, and soon you're bombarded by solicitors looking to offer you a home loan. The scary thing is, you the buyer have no control

over who that 3rd party is. You can’t prescreen or vet them, and can’t control what becomes of your private information.

In a world where buyers now need to be very cautions, the online home loan application process can be very careless. These online lead generation companies are WRONG! They are wrong for tricking the buyer into thinking they are getting information, and end up having their credit pulled. They are wrong for offering free advice to lure the buyer into applying; then turn around and sell that buyer's name and info to a 3rd party.

Loan officers and realtors will pay as much as $500 for a single lead, which they fully intend to recoup in commissions, so there is great value in possessing the buyer's data. The way the buyer is tricked into applying is wrong; and just as bad is taking away the buyer's right to choose, by forcing them to apply before getting any information.

In my introduction I pointed out that I am passionate about fighting injustice.

It's deplorable, in some cases criminal, that potential home buyers are being forced into a lead funnel for random lenders or loan officers to call them.

Buying a home is the biggest investment most people will ever make, but the problem is very few buyers know that

there is a way to take control of the process. But I will soon change that.

To review: As it sits today, you go to a random homeownership site, enter in your personal information, then wait for an army of loan officers to call you. Which is crazy! How do you know if any of those callers are trustworthy?

What if the person you give your personal information to does not have your best interests in mind? How do you even know that they are who they say they are? Have you actually done your due diligence? Who is interviewing who here?

This process is dangerous. You should never enter your information into a search engine unless you know WHO, specifically, you are applying with. So where do you start your search if you want to be assured of the best outcome? What is the smartest process?

Let's examine the standard methods for starting your home buying search.

THE DEFAULT OPTION

You find home ownership sites online, by searching “low rates", or "calculate my mortgage payments", or "find a lender”, and up comes any number of "apply now" websites. These sites prompt the prospective buyer to enter in their personal information and wait for a callback. The loan officer,

(or loan officers) who call could be anyone from anywhere. Typically loan officers pay for these types of leads, and the buyer's info becomes their "gold mine". And unbeknownst to you, the buyer, your personal information is then sold multiple times over to numerous lead purchasers. Additionally, some of these sites make extra money by selling your data to companies outside the mortgage industry. Next thing you know, you are being barraged with spam emails, telemarketers, and robot phone calls trying to sell you everything from timeshares to life insurance to IRS protection... ad infinitum.

How does a buyer prepare for the barrage of calls, or analyze upfront how to sort out and/or vet the callers? You really can’t, and that is the problem. You are advised to get a number of offers from these loan officers. But this will result in all of them running your credit. This will usually end up hurting your credit score; perhaps to a point where you now no longer qualify for a loan. How ironic is that? In other cases, depending on who buys your personal info, you could end up a victim of ID theft.

A crafty salesperson, who you don’t know, and didn’t choose, will then convince you to send them all of your personal income, banking, and credit info... and now they all have your private information, because as far as you know,

you don’t have any other options. And now you are as exposed as if you'd had your wallet lifted by a pickpocket.

It's funny how we are so trusting of Uber and Amazon that we feel the loan officer, who is viral, is just as safe. But you aren’t giving Uber or Amazon your pay stubs; and if the driver or package doesn't show up, you still have a home. In a day and age where one can prequalify their online dating partners, one cannot prequalify the lender they chose as easily; so the buyer is left divulging financial data and then waiting and trusting that everything will work out. This is an often disastrous way of attempting to get preapproved. Scary to report, but I know many buyers who've had to change their phone numbers over the litany of calls that come from this method.

THE UNKNOWN REALTOR REFERRAL OPTION

First, you find a home that gets you excited. If you haven't already, you meet a realtor and trust that they'll refer you to the right lender. But how do you meet this realtor? Most prospective home buyers do it by finding a home online and calling the number on the listing. Did you know that more often than not, the number on the listing is for a realtor paying for ad space and not the actual listing agent? That’s right, some realtors pay search engines to put their contact information on another listing agent's property.

This is yet another lead generation tactic. The leeching agent hopes you call them, not knowing that the property you like really isn’t their listing. They want to steal your business from the listing agent. Or, they might even detour you to another property that is their listing.

So if you arbitrarily find a realtor online, and this person connived to land you, can you rely on this realtor to refer you to a trustworthy loan officer? Think about it, you've put yourself in a position where you have NO control over who you use. Do you know that many times realtors and loan officers share in co-marketing fees? This means that the realtor is incentivized to refer you to their loan officer pal because they are splitting marketing costs with them. So the loan officer you may get is strictly looking out for her- or himself. And whatever loan product they say is available to you will be on the high end, thus guaranteeing them a hefty commission.

So do you see how broken this method is, and why you don’t have control? This is why you need to find a GREAT loan officer up front, so you aren’t at the mercy of someone who does not have your best interests at heart. This is one of the biggest purchases in your life and you could end up calling a listing, getting an agent who really doesn’t have the listing, and being referred to a loan officer who is paying for your

business, not earning it. And the biggest issue with all of this is you have no clue if that realtor or loan officer is who they say they are. No clue if they have ever closed a deal before; or if they're co-conspirators, and yet you have given over your personal information without first qualifying who you're dealing with.

FRIENDS & FAMILY REFERRAL OPTION

You use a loan officer who someone you know is familiar with. The referring person has had an exceptional experience with the loan officer they used, and can vouch for them and their integrity. In most instances, if the referral came from a trusted friend or family member, this is the safest method of the three – but it is still not the BEST method (soon to come!)

Generally speaking, you can trust what your family and friends say. Unless… they were duped into the same trap of the Unknown Realtor option. They very well could have landed on an agent and/or a loan officer who was misleading them. They may have gotten great service, but a lousy deal – and they just don't know they were politely screwed.

Make sure you don’t take on a referral by anyone without doing your due diligence and investigating the agent, the loan officer, and the loan itself. Review their website,

check their license for authenticity, visit their Facebook and Instagram sites to see what they're all about. Would you ever buy from an online retailer who did not have a website, a social media presence, and positive reviews or testimonials from satisfied customers? Just because friends or family used them does not guarantee they are going to be GREAT for you, or that you too will get the best deal. Many times when a buyer is referred to an agent or loan officer, that person thinks they have the buyer in the bag, and may not work all that hard for your business. May not strive to get you the best possible loan product.

My advice for you is to "look before you leap". Don’t blindly trust a referral on face value. Do your homework on the person or people; see how they acquired your information. Are they paying for your business? You should choose who you work with – they should not choose you.

CHAPTER 6

ALL THE “RIGHT” MOVES

Where do buyers get educated on where to start the homeownership process? The typical first move – or from my perspective, the first mistake – is going to a search engine and typing in key phrases, such as “first step to home buying, or "first step to home ownership", or "the home buying process.”

Most of the online home buying content today contains information disseminated by marketing departments at various banks. These banks are educating buyers in the hope that buyers apply with one of their loan officers. It’s a funnel, and it's not truly giving away advice for free. It’s education with an agenda, therefore it's not truly transparent. If BANK X is educating you hoping that you'll apply, it's not s

o much education, but primarily lead generation for them. It's "Let’s dangle a carrot so you'll come to us."

If you look closely, on many educational sites you’ll find lenders advertising; meaning these sites are built on the marketing dollars of banks. True education should come from the person who is actually walking you through the process – an independent loan officer, like myself, who is not beholden to any one bank. I have no agenda here – except to make sure no one takes advantage of my clients.

And now, I introduce you to Ben Anderson's...

7 TRUE STEPS TO HOME OWNERSHIP

This is the process I teach other loan officers, and the process I apply myself to my clients.

1. CONVERSATION: Have a conversation with a great (top) loan officer (a little later I’ll discuss how you find one ) about your goals, your reasons to buy, how you got here, and about the process itself. The loan officer is the money and you must have that money available to you before you can shop. Novel concept I know! Most people think the first step is to shop (go looking) for a home. But this puts you at a disadvantage, as you'll soon see. And with today's technology this conversation with a loan officer no longer needs to be between 9-5 in a bank. It can be over the phone, via text, email, chat, instant message, or through social media. With a great loan officer this communication can now be 24 hours a day, seven days a week.

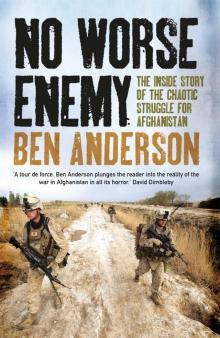

No Worse Enemy

No Worse Enemy Homeowner Now

Homeowner Now