- Home

- Ben Anderson

Homeowner Now Page 2

Homeowner Now Read online

Page 2

All the same, making money at mortgage from 2004- 2006 was easy. Everyone was killing it. Some loan officers

owned 2-3 cars and 3-4 houses; it was crazy. Banks were practically giving money away.

And then, it was like crashing into a wall at 100 mph: The Great Recession hit, wiping out what seemed like 99% of mortgage lending, overnight. Everyone was shocked., "How could this be over?" my peers lamented.

Well, unlike them, I lived and actually prospered through the Great Recession of 2006-2010. And I'm stronger than ever in the real estate business today because I hung in. Most of those I came into the business with have quit the game. Staying with the business has paid off royally for me. I am one of only a few mortgage professionals who can ever say, "I've closed $3 billion... and counting." Furthermore, I've been recognized as "One of the most influential mortgage professionals" by MPA Magazine. I am consistently in the Top 20 in the USA in closed loans out of over 1 million loan officers – primarily because I never quit.

*

"How did he do it?" you might be wondering. My strategy for survival was simple: Banks going under means less competition – but people still have needs.

What I saw that many missed was that when these other loan officers fled the company they left their customers

behind. And the customer should never be left behind – just like my mother should've never been left to defend herself. At that time all of these customer files were in big manila folders; there was no technology, or data base, or e-files. When the housing market crashed everyone bailed ... everyone but me, that is. So, when these other loan officers quit, I noticed what they'd left behind. People. That's who all those deserted files represented. Families.

I looked at all those piles of files and exclaimed, “Opportunity!” I asked the owner, "Would you mind if I stay until the doors are closed for good, and the business shuts down?"

He gave me the go-ahead and the agreement was I'd close any loan I could and help anyone I could. It got to a point where the company couldn’t even afford to keep the lights on

– literally! So, I gathered up all of the files and stacked them against the window where there was some light. It'd gotten so bad that all of the desks were sold off. Imagine a huge 10,000 square foot open sales floor completely empty.

I grabbed a milk crate for a chair, used my own cell phone, and started calling. I went through every single file and spoke to each person. Many of those customers are still with me today.

The lesson is twofold. First: When people are not treated well, you do something about it. Second: And when you do something about it, that's when the unexpected, even miracles, can happen.

The cracks in the homeownership process weren’t all a result of the market collapsing, it was also due to loan officers and real estate agents exiting the industry when customers were in need. Fight or flight, and many in the industry chose to run – and the customers were left in the lurch.

CHAPTER 2

THE GREAT RECESSION – WHAT REALLY HAPPENED

Prior to the crash, the mortgage sales floor was filled with 20- to 30-year-olds, headsets on, selling, selling, selling! And I mean really selling. The atmosphere was electric. Welcome to the world of mortgage, Ben. It was like Wall Street on the West Coast. The activity and excitement was like a mall on Christmas eve. It was everything you see in the movies.

When I'd driven up to the building, the parking lot was filled with exotic cars; BMW’s, Mercedes, Bentleys – even a couple Ferraris. Wow! these guys have it all, I thought, but how?

I entered the building and security let me onto the sales floor with 800+ salespeople in cubicles. On closer inspection I noted that they were all wearing Gucci loafers and Rolex watches. Everyone seemed to be having the time of their lives. They were selling mortgages.

How do you sell mortgages? I had no clue at first, but I knew that by picking up the phone and following a script I could have the life these fired-up kids did. And when I learned what I was really selling to homeowners I realized this was dangerous. We were no longer selling a bona fide mortgage

(which is a loan secured to a home), we were selling money. And I was smart enough to know that selling money doesn’t do justice; because if you sell something, the person buying must give you something in exchange. No, we were practically giving money away, and that's why it was so dangerous.

People were buying homes with $0 down payment, and home values were skyrocketing because this became the new normal. It's supply and demand, just like on the streets. The more demand, the higher values rose. And it seemed that almost everyone was approved – no questions asked – so everyone was buying. Building contractors couldn't put up homes fast enough to sell them. Mortgage Money had become a drug and everyone was hooked. No money down, no income verification, you could buy one home, you could buy ten homes. There was very little qualifying done on people involved in the home buying process.

Many people were buying homes just to flip or sell them the next year; and they were making $100,000 profit or more with each house. As more loans closed, and more people purchased, the looser regulation became.

The cracks in the system began when banks allowed loan officers to give money away. Banks started with easy-to- close loans for those with good credit, then moved into even easier-to-close loans for those with poor credit. They were

short-term loans that ended up increasing the amount of the payments over time. These were called ARMs (adjustable rate mortgage) loans. When these buyers could not afford the sudden "balloon" payment (after a fixed 2-3 years the payment goes way up) they started missing payments or defaulting on the loans. Millions of balloons came due all at once, and the whole U.S. market tanked. People by the millions lost their homes. And I could do nothing but watch it happen.

At that time, I was naïve and not a market expert yet. Like many young professionals in the mortgage business, I did not see the crash coming. I too was blindsided, but the difference was, my experience of dealing with tragedy, as well as my background in sports (never quit!) would be my saving grace. For me, surviving the crash was like surviving on the streets, if I could handle one I could handle the other.

*

Many who lost their homes are still wondering, "What the hell happened?!" The crash was caused by a faulty system. The way mortgage banking is supposed to work is, a bank closes a loan, then sells the loan to an investor for a profit; but not just one loan, typically a pool or group of loans. When that investor is no longer getting its profit because the customer is

no longer making its payments, they start to ask questions and they start to investigate.

In the Recession, investors learned that the loans they were purchasing were filled with unqualified buyers who'd likely be unable to afford the rising payments, so these investors stopped buying loans. This caused a ripple affect which threw the U.S. market into a downward cycle that still affects home buyers today.

The situation at the time was carnage. People were leaving keys on the front porch and abandoning their homes. High level executives at the top 10 US banks were going missing or filing for bankruptcy. Some even committed suicide. Entire families were living in their cars. Thugs were breaking into abandoned homes, stealing appliances, ransacking entire deserted neighborhoods. Some people were so down-and-out they abandoned their pets; and many families were broken, divorced; children taking to the streets to survive. Thousands of companies in the financial sector were closing or laying people off. New housing construction was frozen, it felt like the dead of winter.

CHAPTER 3

HOMEOWNERSHIP BOUNCES BACK – BUT THE PROCESS IS STILL BROKEN

Recently, the market has bounced back, and stronger than ever. Ten years after the Recession, home values have returned to all-time highs. Protective measures have been put in place to assure there's no repeat of 2006-2010. Banks require loan officers, brokers and lenders to document a borrower’s income to make sure the customer can indeed afford the loan. So, you

could say that out of the Recession was born a better, more dependable process. Home buying has become a safe venture again; albeit with a surfeit of regulations and restrictions.

One of the greatest myths in the world today is that, thanks to the Recession, home ownership is now very hard. Well, I'm here to bust that myth. Millennials today, not Baby Boomers, make up the largest portion of home buyers. But time and again, when I talk to them, I find that many Millennials don’t understand the process – where to start and what it entails to come out ahead at the end of the game. Many Millennials I meet think home ownership is the Mount Everest of life. They believe that only a few privileged people have what it takes to become a homeowner, and truly are able to live the American Dream.

The current banking process is so broken and over- regulated that most potential first-time home buyers would rather pay someone else’s mortgage (rent), than take the steps to have someone else eventually start paying theirs for them. The injustice served on the American home owner in the Great Recession has badly scarred the Millennial generation – if not by going through the process themselves, then by watching their parents suffer the housing crash.

*

Yes, the process is broken, and the dregs of it are standing in the way of many hard-working citizens being able to achieve their American Dream of being a homeowner. To me this is the real injustice today – and one I fully intend to rectify and set right.

If you want to have true wealth there are only a few options:

1. You must invent something everyone wants or needs;

2. Build a business from scratch;

3. Be lucky enough to win the lottery;

4. Inherit a fortune; or the most common;

5. Invest wisely with the dollars you earn.

If you aren’t the next Mark Zuckerberg, if you haven’t bought the winning lotto ticket yet, or aren’t next in line to

take over a billion-dollar family business, I suggest you think about investing (wisely) in what you can control: home ownership. But the problem with this option, as I've pointed out before, is that the process is badly broken.

Perhaps the greatest truth in the world, or at least in America, is it's hard to attain wealth without equity, and it's next to impossible to create equity without having a home. And the bonus is: A home is the only investment that you can live, laugh, and love in. It's not just an investment, it’s a LIFE. So why does having it seem so hard?

The truth here is that homeownership is actually easy, and it's for everyone. Throughout the course of this book, I will show you how easy home ownership can be. If you have a job, have enough to put down on a rental (first, last, security), even if you have less than perfect credit, you can still own.

Not only can you own in 10 years, you can own today! And you should own today. Homeownership is the bedrock of America; it's the backbone of family, and it can be for everyone.

So how is home ownership simple? It's simpler to qualify than most think, and the value proposition of owning a home is also simple. You want to buy things today that historically are worth more in the future. Homeownership

happens to simply be the only thing you can buy, live in with your family, and have it be a good investment at the same time.

Unless you are living with someone for free, either you are paying rent, or paying a mortgage. Since there's a cost of living either way, shouldn’t that cost go back to you? Pretty simple, right? Think about it: If you have $1000 in rent to pay, that money goes toward your landlord as income. There is no financial gain. That's money paid to "borrow" someone else’s home.

If you own your own home and your mortgage payment is even $1250, that money all goes toward you. That $1250 is either a tax write-off, or is paying off debt.

If you have a car loan that you pay off, that car still has value, even though it's less than what you originally paid for it. But eventually, that car will need to be replaced, traded in, or sold for parts. That car is also not a necessity, it’s a want. Most people don’t need a car (thanks to Uber and Lyft); they want a car. But you need a home.

Historically, the home, once paid off, has gone up in value. If you buy a home and get a 30-year mortgage, history tells you that the value of your home will double in 30 years. Simply put, you need to live in a home. So what makes more

sense? Renting and paying someone else’s mortgage off? Or taking your hard earned money and paying off your home mortgage?

CHAPTER 4

YOUR CHOICE IS BROKEN, TOO

Buying a home today can be compared to having a child. My wife, Morgan, and I have three, so I know; she knows the pain, and I know her pain. The pains of working so hard for the child you love more than anything in the world is parallel to working so hard to save and save to have that home. Morgan is a true hero to me, she fought through several miscarriages and difficult pregnancies to deliver our three beautiful children.

The process you go through when you want to buy a home is a lot like the pregnancy; as Morgan would say: "Very uncomfortable, it makes you nauseas, you're exhausted, and you want the madness to end so you can just enjoy what you’re there for." Then it happens and you have your child (or home), and you forget to some extent what you had to go through. Well, home buying is much the same.

The pregnancy of home ownership is as follows: When you apply for a loan, a licensed loan officer (one of many changes from the Recession is we weren't licensed before), takes the buyer's application; either in person, over the phone, or online. Then the "fun" begins. You are asked to provide a list of items needed in order to qualify. This list can be a very

specific itemized one the loan officer or their team puts together; or it can be a generic computer generated one.

This is where you could lose – right out of the gate. To start with: How qualified is that loan officer who gave you this list? If you get off to a poor start, you may never recover.

Here is a common trap: Some mortgage companies make the buyer think you can push a button and POOF! you've got yourself a loan. Are you kidding me? There are some basic things you'll need to know if you were to try and secure your own mortgage: What loan product do you chose? 30-year fixed? 15-year fixed? 10-year fixed? Interest only? Home equity line of credit? Reverse mortgage? 40-year loan? 10/1 ARM? 7/1 ARM? 5/1 ARM? 3/1 ARM? FHA? VA? Buyer paid

mortgage Insurance? Lender paid mortgage insurance? And I'm just getting started.

So, if you could simply push a button and get a mortgage... which of the 50 or so buttons (or combination of buttons) would you push to get the exact right loan for YOU? That's why an expert loan officer is critical to the home buying process.

But how do you know if the loan officer you are working with is indeed an expert? Would you opt for a serious surgery without vetting the surgeon? Of course not. Then why would

you buy a home without vetting the loan officer? (More on this later.)

Okay, at this point, you, the buyer, are paired with a loan officer (expert or not) who gives you a list of items needed to buy. You get busy and provide the officer with everything on the list – only to discover that between the day you started and the day you finished this initial list, 20 more itemized items are coming.

Why is this? Good question.

The answer: The average loan officer would be way below average at most other jobs. That’s right, he or she is not equipped to handle your purchase. The bar of entry is very low; 20 hours of online training and an easy-to-pass test; then a loan officer is allegedly "qualified" to handle your most important life investment? I don’t think so. This is another reason the process is broken. Most banks or lenders when hiring a licensed loan officer, don’t train them. That's right they really don’t train them. This loan officer is licensed to help you buy, but they've never closed a loan; or only a few, at best.

Loan officers are 100% on commission in most cases; so from a bank's perspective, why not hire more loan officers? You aren’t paying them if they don’t close a loan, right?

There

are about 1 million loan officers and just over 1 million homes purchased every year. It doesn’t take a mathematician to tell you that most loan officers aren’t handling that many loans. Banks have these secret reports that tell them how many loans each loan officer is closing. I have seen these reports and you would be shocked to know the average loan officer closes less than 1 loan per month. The average loan officer does not have the experience to get you the best deal.

Can you see why you need a highly qualified expert? But you, the buyer, are not being educated on how or where to look for this expert loan officer. In a world where consumers have control over just about everything they do – where they eat, what type of Uber they want to ride in, what online food delivery service they use, what movie to stream from home, what doctor, dentist or plumber they use – there is a lack of information on where to go and what to do when buying a home. In this modern day "my choice, my way" era, buyers rarely have an informed choice of which loan officer to use. And when it comes to choosing a real estate agent, how does the buyer know whether they're getting an expert or an amateur? Many times a buyer falls in love with a house they see online, then contact the realtor they think is representing that house. You could later be shocked to find out that agent is an interloper. If you found the home online, the realtor you

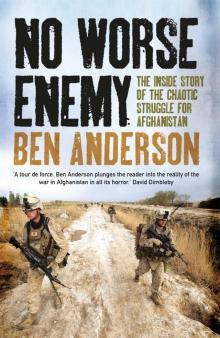

No Worse Enemy

No Worse Enemy Homeowner Now

Homeowner Now